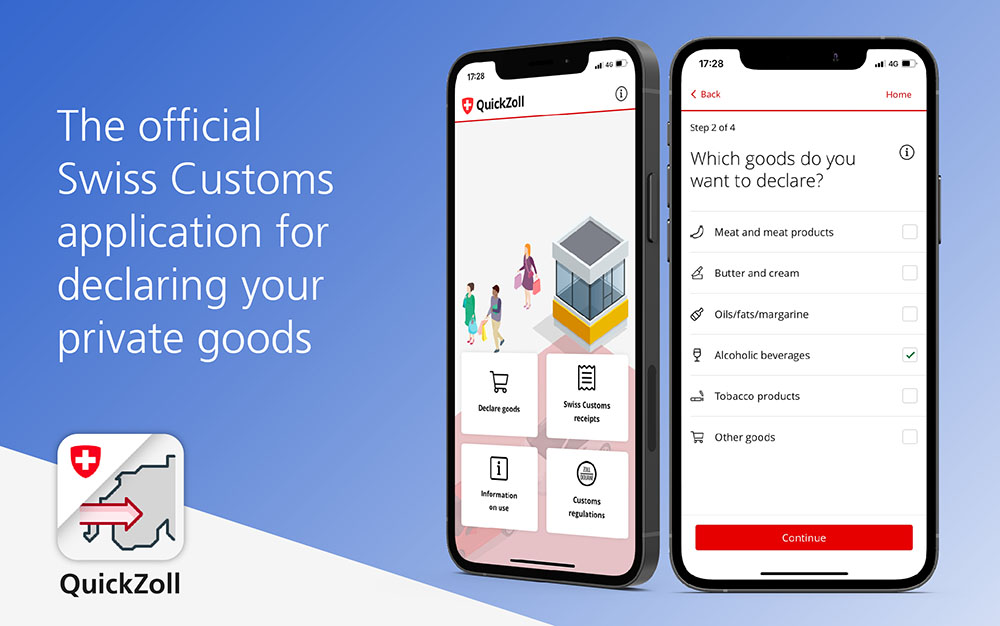

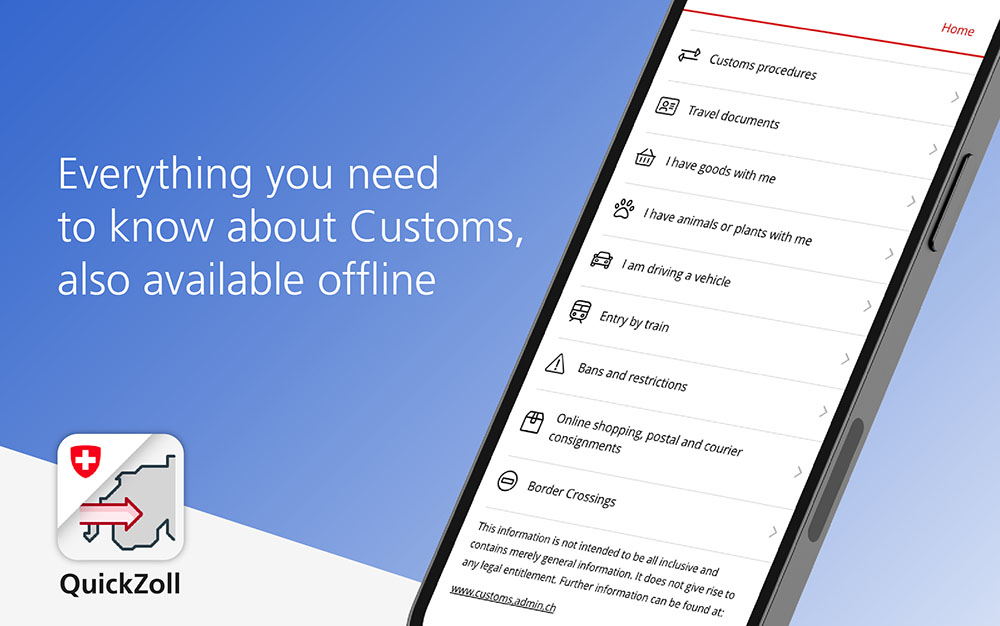

QuickZoll simplifies your return from your travels. Declare your personal purchases or gifts autonomously, pay any duties owed, and access key information on entering Switzerland – all on a single official app.

A simple alternative, available 24 hours a day

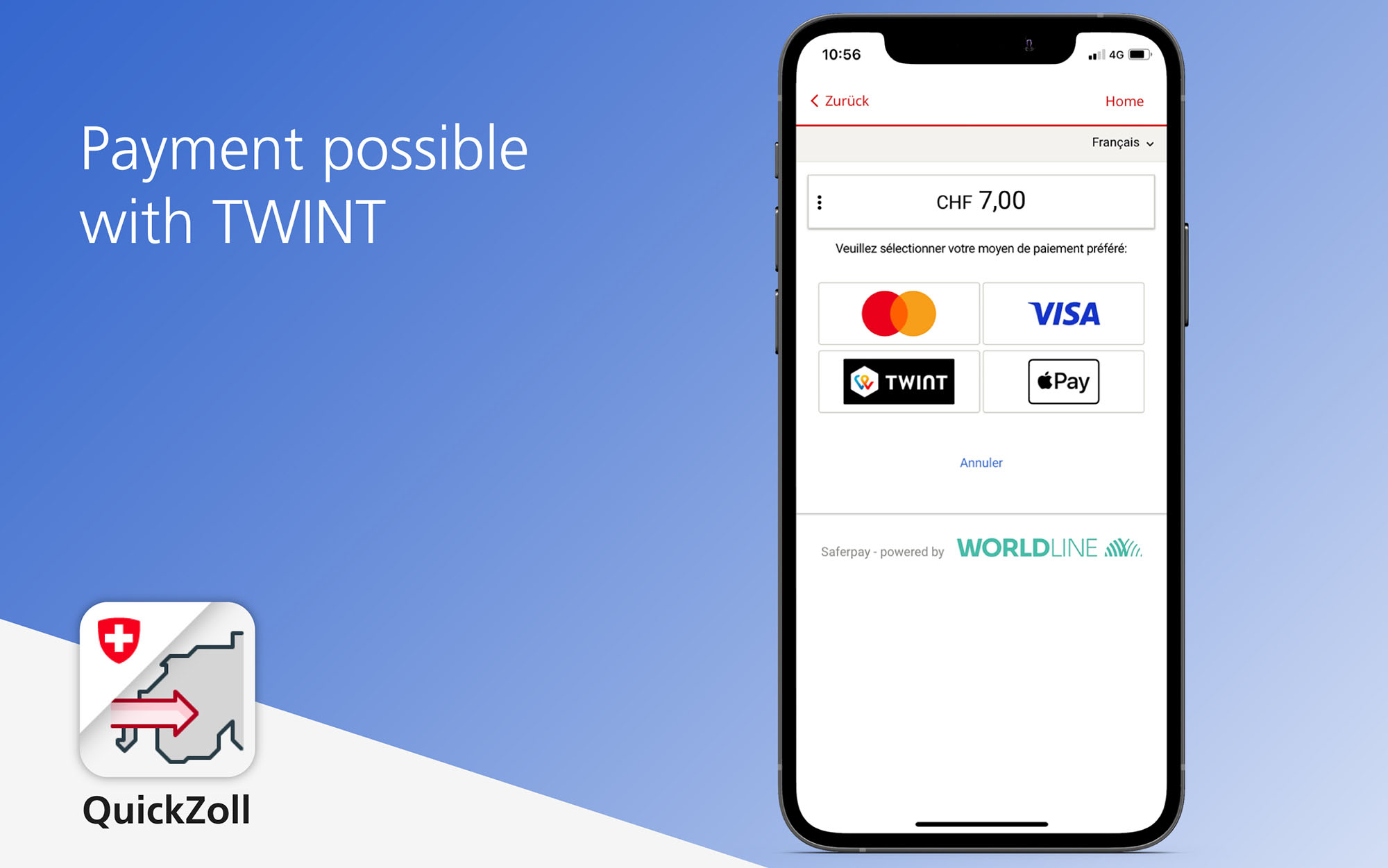

QuickZoll lets you declare the import of goods intended for your private use or as gifts autonomously, without waiting at the counter. It works everywhere, at any time and does not require you to register in advance. When paying the duty, you simply need to indicate a two-hour window during which you will be crossing the border. You can then import the cleared goods through any border crossing.

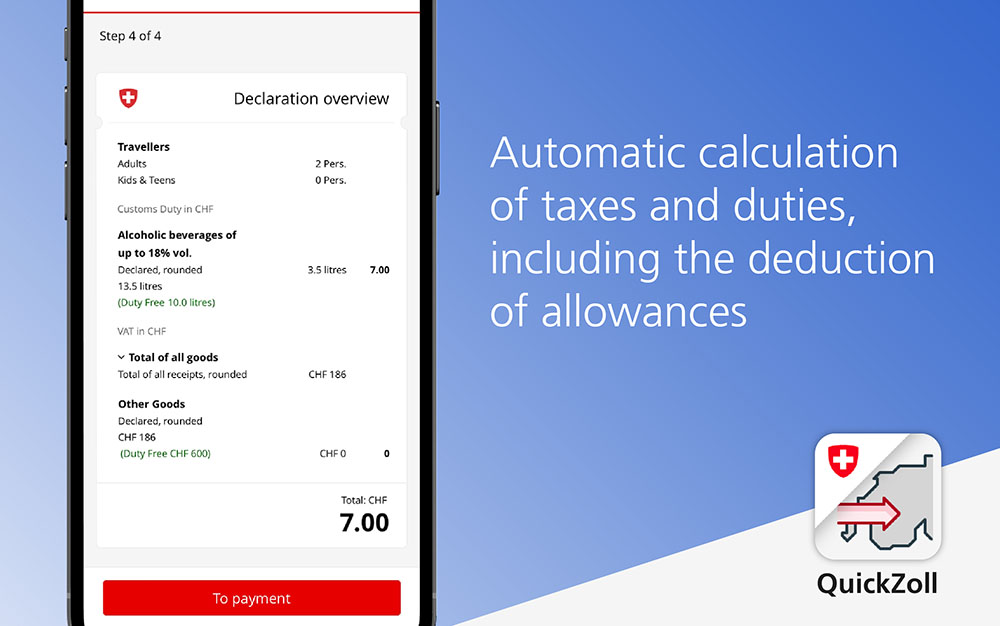

The best solution for importing goods at the normal VAT rate

QuickZoll applies a standard VAT rate of 8.1%, which makes goods declarations considerably simpler.

The reduced rate of 2.6% is not used, which avoids users having to enter a different VAT rate for each product. So for items that are taxed at the normal rate, the app is the simplest and most efficient solution: it saves time and avoids customs formalities at the border.

List of frequently imported goods and their VAT rates:

Goods |

VAT rate |

|---|---|

Clothes, shoes |

8.1% |

Electronics, accessories |

8.1% |

Cosmetics, perfume |

8.1% |

Wines, spirits |

8.1% |

Watches, jewellery |

8.1% |

Furniture, garden furniture, outdoor items |

8.1% |

Cigarettes, tobacco |

8.1% |

Food |

2.6% |

Medicines sold in pharmacies |

2.6% |

Books, newspapers |

2.6% |

N.B.: Some goods are subject to restrictions, authorisations or bans and cannot be declared using QuickZoll. This is the case for vehicles, weapons and live animals, for example (see the complete list in the QuickZoll terms of use (PDF, 43 kB, 07.05.2025) (PDF, 43 kB, 07.05.2025)). You have to declare these goods at a border crossing staffed by the FOCBS.

N.B.: Some goods are subject to restrictions, authorisations or bans and cannot be declared using QuickZoll. This is the case for vehicles, weapons and live animals, for example (see the complete list in the QuickZoll terms of use (PDF, 43 kB, 07.05.2025)). You have to declare these goods at a border crossing staffed by the FOCBS.